National Auto Insurance Provider

Bending the Diabetes Cost Trend

A national auto insurance provider with 2400 employees, that is fully insured and experience rated with their health insurance provider identified diabetes as one of their top chronic conditions driving up overall healthcare costs due to poor adherence to care standards and high hospitalizations. To bend their cost trend, they implemented the Diabetes Care Rewards Program.

A national auto insurance provider with 2400 employees, that is fully insured and experience rated with their health insurance provider identified diabetes as one of their top chronic conditions driving up overall healthcare costs due to poor adherence to care standards and high hospitalizations. To bend their cost trend, they implemented the Diabetes Care Rewards Program.

Implementing the Diabetes Care Rewards Program meant a shift in thinking to provide a benefit enrichment that was confidential for the member and comprehensive in scope to attack the high costs drivers.

In the past 4 years, our client has seen dramatic results as demonstrated by a 43% rate of engagement among employees, spouses and dependents, which is more than 3 times the national average for disease management programs. Additionally, 46% of program members were fully adherent to program components. and as a result received all diabetes medications and supplies at zero co-pay.

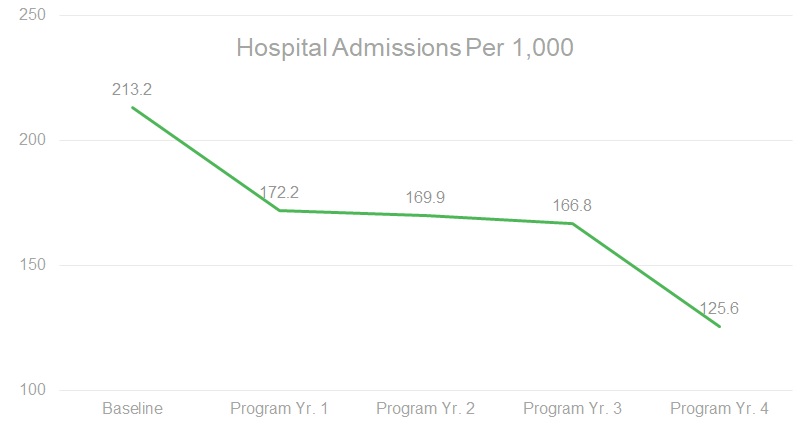

With increased adherence to care standards with members’ own doctors and improved medication adherence, the Program yielded significant reductions in both hospital admissions and length of stays for all members with diabetes.

Participation & Adherence

as compared to national disease

management programs

to all program components

Co-Payment Waivers Years 1-4

Hospital Admissions